Can we fix it? Yes! How to save for home repairs.

If forecasts are correct, many people will become first-time home buyers this spring. Those buyers are probably running the numbers now: This much for the mortgage, this much for property tax, a bit more for utilities... Some of them will get renovation loans that allow them to rehab a fixer upper and make it fit for fine living, but many won't think to include the cost of ongoing maintenance into their budget.

While we want to be the kind of homeowners who don't need a credit card when facing an unexpected repair, we historically have not done enough (see also: done anything) to plan ahead for home repair costs. The fact that we did not have any money set aside for emergencies or basic home maintenance became a source of constant and sometimes overwhelming stress. Because of our lack of planning, emergency repairs almost always meant accruing debt.

Last summer, we used our credit card for what we hope will be our last unfunded household emergency: A nearly $3,000 plumbing repair that had to be completed on short notice. After that, we knew it was time to make some changes and use our budget to buy peace of mind.

While the thought of a leaky roof or failing refrigerator made me feel completely queasy, I wasn't sure where to start when budgeting for home repairs. First, we did some homework to find out how much we should be saving (and I share what we learned below!). But just because we knew how much we should be saving, that didn't necessarily mean that we could save it. It took about four months of cutting back our monthly expenses before we were in a position to start socking away some funds into a home repair savings account this year.

Below are two tools we looked at when we estimated how much we should save.

HOME REPAIR BUDGET TOOL #1:

The Thorough Way

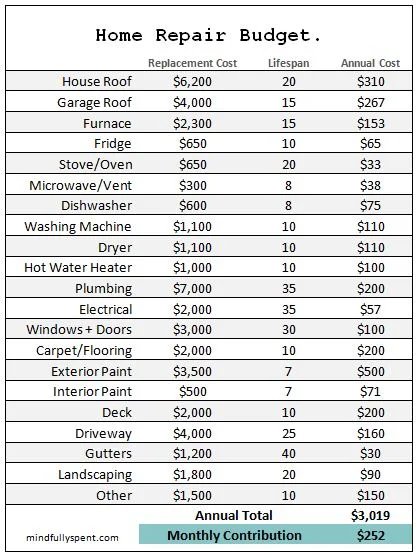

While there are less complicated ways to estimate how much to set aside for household repairs, a thorough understanding of what could go wrong and what it would cost to replace things was important for my peace of mind. I put my student-loan-funded education to work, and set out to outline a detailed repair and replacement fund for our own home instead.

How our house is unusual.

Here are a few factors I kept in mind as I figured out our estimates: 1. We live in a higher priced market where services aren't cheap; 2. Our house is luckily very small (just 790 square feet!) so we are able to stick to the lower side of most estimates; 3. I usually buy my appliances "like new" from an outlet store; and 4. Our washer and dryer are an exception to that because they are in an extremely small space - To replace them with a set that can run decent side loads, we would have to shell out for premium "space saver" appliances. This more thorough budgeting tool helped us create a savings amount that is specific to our needs.

Here's what we came up with!

Finding the facts.

We are not experts in home construction and repair. When we weren't sure how much to estimate, we used the Home Advisor True Cost Guide to look them up. Some quick Google searches helped us learn how long we could expect things like a furnace to last. That said, our limited expertise means that this is just a rough estimate that we may need to adjust over the years. We also didn't include the cost of things like lawnmowers or small repairs like bathroom fans. We use our "other" category to cover some limited costs, but we'll try to cover these smaller expenses as they arise (as we have been) and save that "other" category for when we truly need it. (Maybe you are an expert and have spotted an estimate that looks inaccurate? Let us know!)

Starting from zero.

It's true that not all of the things in our house are brand new. We're starting with zero dollars in our budget when many of our appliances could die quite soon. That said, we have replaced the electrical panel, furnace, water heater, and most windows since we've lived in our home, so some of the major components have some life left in them. We can also defer non-essential repairs like carpet, interior paint, and other purely cosmetic things until we have a good amount of cash stocked up. A surprise check in the mailbox also gave our savings account a boost as we got it started. Money Smarts has a more complex tool that can help you account for the age of existing fixtures and appliances if you want to consider a more complex model.

HOME REPAIR BUDGET TOOL #2:

The Quick & Easy Way

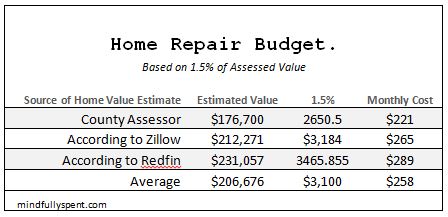

A quick search of the web will show you that many advise setting aside between 1-4% of the assessed value of your home each year for repairs and maintenance. This made me wary for many reasons: 1. Assessed values, assigned by taxing authorities, are not always accurate; 2. Assessed values can be affected by things that are completely unrelated to home repair costs (like the quality of the school district); and 3. A range of 1-4%??!!! There is a world of difference in those estimates. Here's an example that highlights the imprecise science of a home repair budget based on value: We could own a much larger home just a half hour away with a lower assessed value (we are close to commuter rail and a walkable historic downtown). This much larger home would be more expensive to maintain and repair than our cozy abode, but a savings rate based on assessed value would have us putting aside less money than we do for our cozy 790 square foot home.

All these worries aside, "The Easy Way" actually did come close to the estimate we got when we tried to account for all factors -- especially when we used multiple sources to calculate our house value:

While online sources advised anywhere between 1-4% for home repair savings, 1% and 1.5% seemed to be most commonly recommended. Because of this, I used 1.5% in the example above. If we were using this tool, we would use the average of all three sources to determine our savings rate.

The future and our home repair budget...

We have a backlog of projects and we want these dollars to be accessible for emergencies, but savings accounts don't generally have interest rates large enough to keep up with the rate of inflation. We plan to reevaluate our home repair budget annually using the assessed value method and ensure that we increase our contributions by enough annually to keep up with the rising cost of living. We'll also start to thing about setting aside additional money that can be used for renovations instead of just basic maintenance and repairs.

Are you interested in test driving these tools?

Start your home repair budget now. You can estimate the costs for your home using either of these tools: Download the Mindfully Spent Home Repair Budget Tool (xls). Plug in your own house values or estimated repair costs, and then let us know what you think! Sign up for the Mindfully Spent Newsletter and have future budgeting tools delivered to your inbox.